As Broadway shows reopen, theatergoers are waiting longer to buy tickets.

Unlike prior seasons, many ticket buyers are purchasing Broadway tickets one to two weeks before or even the day of the show, rather than several weeks ahead of time, according to ticketing companies and producers. The buying trend underlies the uncertain and evolving landscape of the industry’s return as Broadway shows vie to attract non-tourist audiences.

Many Broadway shows saw a sales spike when tickets first went on sale this summer, ahead of fall reopenings. Now that the advance sales window has dramatically shortened, producers have less clarity about a show’s trajectory.

“It’s a bit more nail-biting than it had been in the past where you would normally see much higher sales eight weeks out, six weeks out, four weeks out even,” said Jeremy Kraus, managing partner at Situation marketing agency.

The change in ticket buying behavior comes as consumers wait longer in order to monitor COVID-19 conditions and ensure the show is happening and as audiences are composed of more locals who are able to make decisions closer to the show.

While visitors are traveling to New York City, tourism numbers are still down, with an expected 34.6 million visitors in 2021, compared to 66.6 million in 2019, according to marketing and tourism agency NYC & Company.

Broadway ticket sales typically start to pick up two weeks away from the performance date, Kraus said. But buying patterns are not the same across all shows. Kraus notes that “Wicked,” for example, appears to be unaffected by current trends and has had strong sales throughout.

Overall demand is difficult to track this season as the Broadway League is not publicly reporting grosses. A glance at online ticket availability shows blocks of unsold seats across several running shows, particularly in the mezzanine and balcony areas. There are some exceptions, including “Hamilton,” which appears to be consistently full.

Still, it’s early in the industry’s reopening and in the life cycle of many shows. After a staggered beginning, there are currently 23 shows running on Broadway and two more will start Thursday.

Many of the returning shows have received millions of dollars in grant money from the government, as well as insurance proceeds, which could help productions weather weak sale periods.

At “Come From Away,” which reopened on Broadway on Sept. 21, producers Sue Frost and Randy Adams say the show is selling well from Thursday through the weekend, while the Tuesday and Wednesday shows are somewhat more challenging to fill.

The pattern of theatergoers buying tickets two weeks ahead of time or the week of the performance has been consistent at “Come From Away’s” reopenings in London, Australia and New York, Frost and Adams said.

On Broadway, the producers have begun to see growth in the group sales market, even as school groups have not yet made a large-scale return. And overall, Frost and Adams feel the momentum picking up as theatergoers begin to attend shows and tell others about the experience and the safety measures.

“We’ve been up for almost four weeks now, and some of the other shows that have been up for five, six weeks you’ve seen that those people and that word-of-mouth is beginning to really have an impact,” Frost said.

The next boost could come from the return of international tourists starting Nov. 8, when the U.S. allows fully vaccinated individuals from abroad to enter the country. As it stands, noncitizens traveling from the United Kingdom, China and most European countries are not allowed to enter the U.S., with few exceptions. The U.S. will also open its land borders in November to vaccinated travelers from Canada and Mexico.

However, international tourism is expected to be more muted than usual, with a predicted 2.8 million visitors in 2021, compared to 13.5 million in 2019, according to NYC & Company.

More notable trends are emerging within the audiences that have returned.

Data across several Broadway shows that have opened or reopened has shown an increase in the number of audience members under the age of 45, Kraus said, as well as in attendees from lower income brackets — which may be due to outreach or a greater number of discounted tickets.

At TodayTix Group, which built its brand on selling last-minute tickets, the breakdown of sales have largely remained the same this season, with about 25% of purchases taking place the day of the performance and 20% to 25% within the week.

As usual, most of its buyers live within the New York City area. However, TodayTix has not yet seen a large rebound in sales from its regional buyers, meaning those who live 90 miles outside of the city.

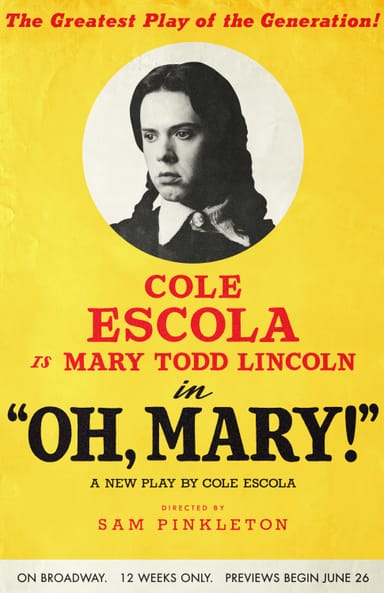

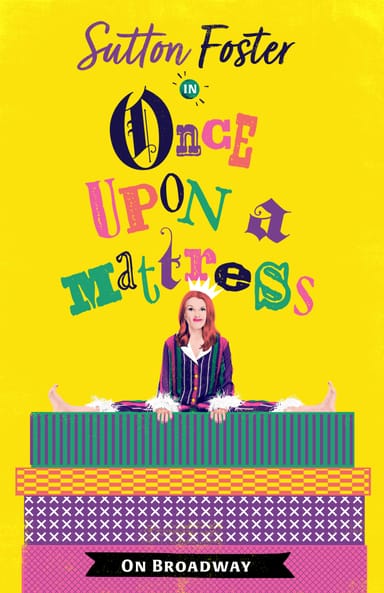

Recent post-show surveys have shown reviews are no longer a top deciding factor. TodayTix customers are largely choosing what to see based on the performers in the show, as well as the price point. And they’re gravitating toward musicals and comedic offerings.

“Customers are looking to be entertained, and we’ve had a lot of hard headlines and tough times in the last year and a half, so it’s not so surprising to me,” said Emily Hammerman, vice president of theatre at TodayTix Group.